by Gregg A. Masters, MPH

Day one of the ACO Alignment Summit kicked off in Alexandria, Virginia with excellent presentations from Diwen Chen, Executive Director, Payment Innovation and Accountable Care, Dignity Health, and Michael Donahue, MBA, Vice President, Network Development and ACO Activities for Eastern Maine Healthcare System (EMHS).

Dignity Health a hospital system founded in 1986 with 38 hospitals is the fifth (5) largest hospital provider in the nation and the largest non-profit health system in California. Dignity Health operates 32 facilities in California, with three (3) in Arizona and three (3) in Nevada. The Dignity Health system medical staff boasts 9,000 affiliated physicians, and 500,000 members via four sponsored health plans.

Eastern Main Healthcare System (EMHS) is a regional integrated delivery system serving all of central, eastern, and northern Maine. Beacon Health, LLC is the organizational model which supports EMHS’ designation as a Pioneer Accountable Care Organization.

Eastern Main Healthcare System (EMHS) is a regional integrated delivery system serving all of central, eastern, and northern Maine. Beacon Health, LLC is the organizational model which supports EMHS’ designation as a Pioneer Accountable Care Organization.

Beacon Health, LLC is one of the remaining 19 Pioneer ACOs piloting a program designed to improve the coordination, efficiency, effectiveness, quality, and cost of healthcare.

[NOTE: For more information see: EMHS Beacon Health Pioneer Accountable Care Organization.]

ACOs are key drivers implementing the ‘triple aim’ vision of the Affordable Care Act. At core the intention is to improve the care delivered to Medicare patients, while transforming the overall healthcare delivery system from volume to value. EMHS deploys approximately 8,000 people in this transformative commitment to accountable care.

According to CMS Beacon Health, LLC experienced the following since admission to the program:

Performance Year 1 (2012): Gross Savings 5.0%

Performance Year 1 (2012): Gross Savings $4.05 Mil

Performance Year 1 (2012): Earned Shared Savings Payments $2.03 Mil

Performance Year 2 (2013): Gross Savings 5.6%

Performance Year 2 (2013): Gross Losses $-6.26 Mil

Performance Year 2 (2013): Earned Shared Savings Losses3 $-2.89 Mil

A limited recap of the day’s presentation highlights is below:

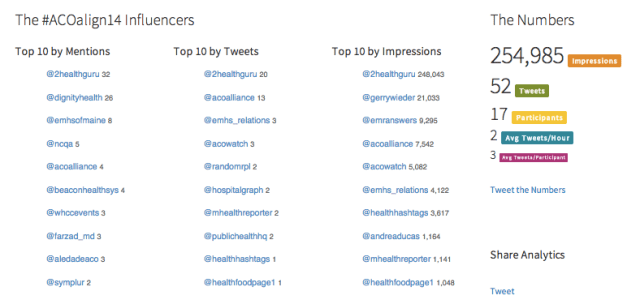

The twitter transcript is here, the updated analytics report here and dashboard here. Reach analytics for Day 1 are pasted below: