by Gregg Anthony Masters, MPH Some of you may have heard about the whining by UnitedHealthcare’s leadership on a recent earnings call which included the required ‘management’s discussion or operating results and market conditions’ analysis. A BIG WHAAAA! Overfunded since inception and having perfected the art of ‘upcoding‘ (i.e,, severity of illness and intensity of …

Tag Archives: innovation

CMS Announces 2019 Shared Savings Results

by Gregg A. Masters, MPH Some eight plus years in, ACOs are still earning their ‘shared savings‘ industry ‘sea-legs’. While they remain a central actor of transformation from volume to value birthed by the ACA for both the public (Medicare and Medicaid) and private (commercial health plans) sectors, the results are continuing to build. The …

Continue reading “CMS Announces 2019 Shared Savings Results”

Surprise Medical Bills In Context: Is Tech the Solution?

By Fred Goldstein, MS and Gregg Masters, MPH It’s Q1 2020 and everyone is now rightfully preoccupied with the recent World Health Organization (WHO) declaration of the COVID-19 as a global pandemic. Congress, the White House, National Institutes of Health (NIH), the Center for Disease Control (CDC) and local state and county health departments (collectively …

Continue reading “Surprise Medical Bills In Context: Is Tech the Solution?”

Health Care ‘Texas Style’: A Model for the Nation?

By Gregg A. Masters, MPH This a re-post of an article written in October 2009 following Atul Gawande‘s article in the New Yorker on the ‘cost conundrum‘ which launched his presence and eventual celebrity on the national stage. Gawande was calling attention to the regional variations (small area analysis) in the Medicare spend and associated …

Continue reading “Health Care ‘Texas Style’: A Model for the Nation?”

ACOs and Value Based Care: The Best of Times Or The Worst of Times? It Depends!

By Fred Goldstein, MS and Gregg Masters, MPH This past year has seen major changes to the Medicare Shared Savings Program (MSSP) that launched the huge growth in Accountable Care Organizations (ACOs) a principal workhorse in the transformational copy of the Affordable Care Act (ACA). It seems that the Center for Medicare and Medicaid Services …

Continue reading “ACOs and Value Based Care: The Best of Times Or The Worst of Times? It Depends!”

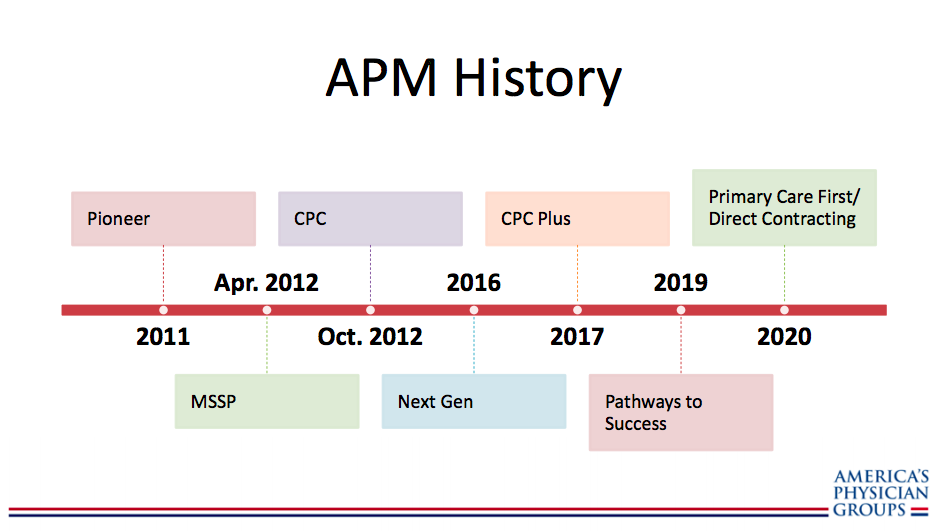

APG: Overview of CMMI New Models – Primary Care First and Direct Contracting

by Gregg A. Masters, MPH The future is already here, it’s just unevenly distributed – Attributed to William Gibson As a soldier mainstreaming both HMOs and (‘attorney in fact‘ vs. messenger model) 2nd generation PPOs (that re-priced claims to contract rates) into ‘mainstream medicine‘ in California vs. the then prevailing 2nd or 3rd tier physician/provider …

Continue reading “APG: Overview of CMMI New Models – Primary Care First and Direct Contracting”

Venrock’s 2019 Healthcare Prognosis

by Gregg A. Masters, MPH Received this embargoed report earlier this week. Venrock has formally released the report this morning. One reason I am fond of their work is I’ve been following Bob Kocher, one of Venrock’s principals, since the turbulent introduction of the ACA by the Obama administration. More recently perhaps due to Venrock’s …

From HMOs and PPOs to ACOs and DPCs: What’s Next?

by Gregg A. Masters, MPH It may come to a surprise for some that ‘healthcare innovation‘ has been in play for quite some time albeit not fueled by a culture of hacking or disrupting legacy operations principally via technology. Unfortunately a veritable acronym soup of mostly failed initiatives under varying degrees of public, private partnership …

Continue reading “From HMOs and PPOs to ACOs and DPCs: What’s Next?”

The Evolution of ACOs

by Gregg A. Masters, MPH Recently the accountable care industry’s leading ‘skin in the game‘ PPMC 2.0 aka ‘ACOcor‘ equivalent (think PhyCor, MedPartners, FPA Medical, et al) of our time – though Aledade’s model is anything like the pyramid scheme of the PPMC (physician practice management companies) of the 1990s, reviewed the Center for Medicare and Medicaid …

ACOs in the Medicare Shared Savings Program (MSSP): Is There a Fix?

by Gregg A. Masters, MPH The Center for Healthcare Quality and Payment Reform just released ‘How to Fix the Medicare Shared Savings Program‘ with lead author and long term managed health care industry veteran Harold D. Miller, its President and CEO. Some six (6) years into the Affordable Care Act (ACA) provisions specific to Accountable Care …

Continue reading “ACOs in the Medicare Shared Savings Program (MSSP): Is There a Fix?”